Overtourism Solutions That Generate Revenue: The Immersive Gateway Approach

Nov 21, 2025

Overtourism Solutions That Generate Revenue: The Immersive Gateway Approach

The paradox destination managers cannot ignore

Destination managers in Barcelona, Venice, Santorini and dozens of other iconic locations face an impossible choice: restrict visitor numbers and sacrifice revenue, or maintain flows and watch resident quality of life collapse alongside the very attractions that draw visitors.

This is not a theoretical dilemma. Analysis of 88 destinations in the Global South shows that approximately 37% display explicit overtourism signals, with pressure concentrated at a small number of iconic sites rather than distributed across wider destination systems (Immersive Destination Analysis dataset, methodology). Among attractions flagged for high sustainability pressure, 86% lie inside protected or heritage areas – precisely the places that tourism authorities are mandated to safeguard (detailed analysis).

Traditional responses – visitor caps, higher fees, demarketing campaigns, seasonal restrictions – address symptoms but rarely solve the underlying problem: too many people seeking the same limited experiences at the same compressed times and places. Meanwhile, these restrictions generate political backlash from tourism operators and fail to offer visitors meaningful alternatives.

Immersive gateways represent a different approach. Rather than simply saying "no" to visitors, they redesign what "visiting" means. By placing fulldome theatres, flying theatres or mixed-reality galleries at strategic entry points – ferry terminals, cruise ports, transport hubs – destinations can satisfy visitor curiosity while redirecting physical flows away from the most fragile zones. The same infrastructure generates substantial revenue, operates year-round and scales without adding pressure to the destination fabric.

This article examines how immersive gateway investments work in overtourism contexts, drawing on systematic destination profiling, unit economics from operational venues and field experience across marine reserves, heritage cities and island destinations. For destination managers already implementing visitor management frameworks, this represents the next evolution: infrastructure that monetises existing demand while bringing carrying capacity back into sustainable bounds.

The strategic foundations and investor landscape for immersive gateway development are explored in detail in Origins of Wonder: An Immersive Impact Investment, which documents the data systems, financial models and capital pools supporting this emerging infrastructure category.

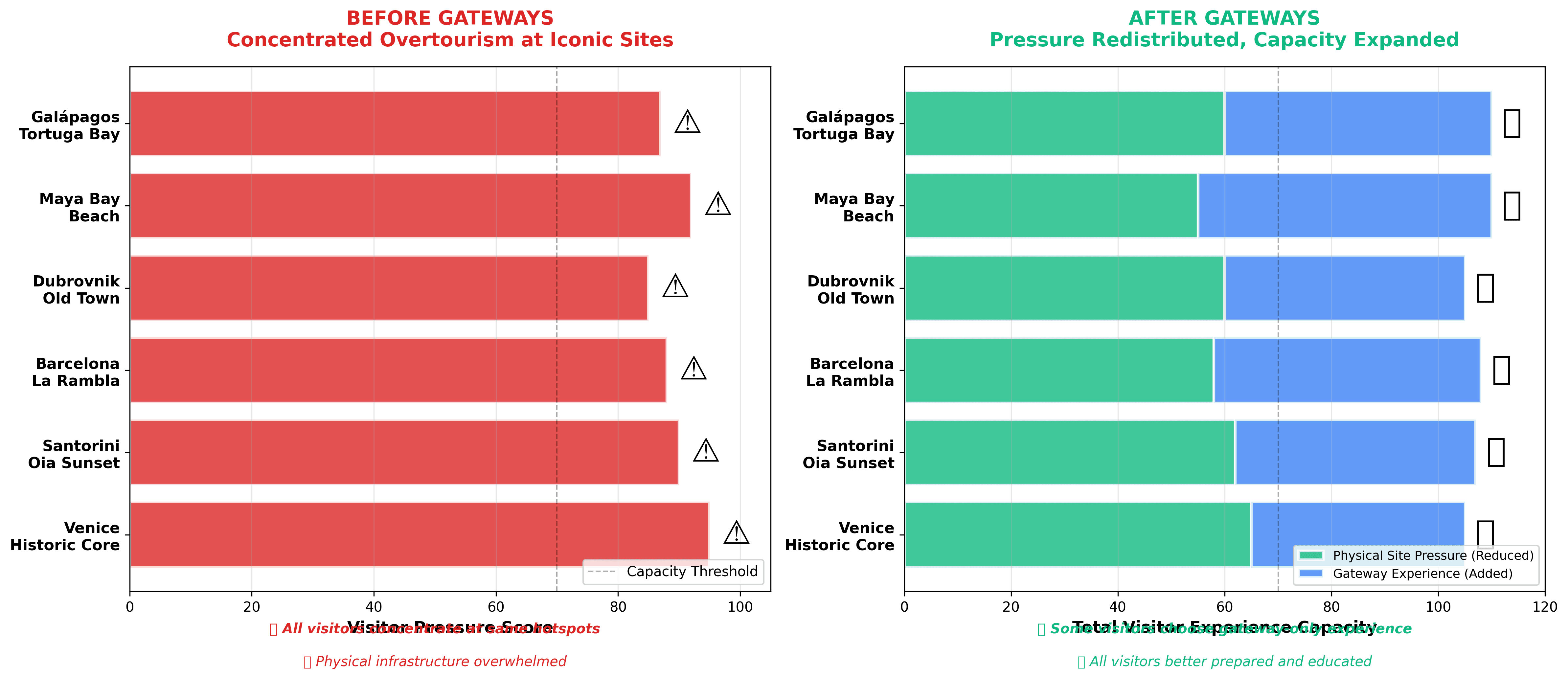

The gateway effect: Six iconic overtourism destinations showing concentrated pressure at capacity-exceeding levels (left) versus redistributed flows after gateway implementation (right). Physical site pressure drops below carrying capacity while total visitor experience capacity expands through gateway alternatives. Green bars show reduced physical site visits; blue bars show visitors served by gateway experiences. Data based on analysis from Immersive Destination Analysis.

Why overtourism is a design problem, not a capacity problem

The standard narrative frames overtourism as "too many visitors." Data reveals a more precise pattern: too many visitors in too few places during too few weeks of the year.

Concentration, not volume, drives overtourism symptoms

Systematic destination analysis across 88 locations shows that overtourism pressure rarely distributes evenly. Instead, it clusters around:

Iconic viewpoints and photo locations: The single cliff edge in Santorini, the Rialto Bridge in Venice, the specific beach cove featured in social media feeds. These locations carry disproportionate visitor numbers relative to their ecological or infrastructural capacity.

Heritage cores and pedestrian zones: Old town districts where narrow streets cannot physically accommodate tour groups, cruise passenger surges and resident movement simultaneously. UN Tourism documentation on urban overtourism highlights how historic city centres become pressure points precisely because they concentrate authentic experiences in compact, fragile spaces (UNWTO overtourism framework).

Access corridors to protected sites: The single boat landing on a marine reserve island, the trail entrance to a waterfall, the shuttle departure point for a glacier. When access infrastructure creates bottlenecks, visitor behaviour becomes constrained and concentrated.

Seasonal peaks with extreme variance: Destinations where July and August visitor numbers exceed off-season by factors of 5x or 10x. Infrastructure sized for peak capacity sits underutilised most of the year, while summer months see systematic overload.

The immersive-destination-marketing dataset (raw JSON, README) tracks 75 attractions across these 88 destinations, documenting how a small subset of high-profile sites absorbs the bulk of visitor attention. Approximately one quarter of tracked attractions are explicitly tagged as marine or coastal environments – exactly the fragile ecosystems where incremental visitor pressure causes measurable ecological damage.

The hidden cost of restriction-only strategies

Destination authorities facing resident complaints and ecosystem degradation often implement blunt restrictions: daily visitor caps, advance booking requirements, higher entrance fees, seasonal closures. These interventions can reduce immediate pressure but create secondary problems:

Revenue volatility and political resistance: Tourism operators, hospitality businesses and municipal budgets dependent on visitor spending resist measures that reduce throughput. Caps on Venice day-trippers generate opposition from ferry operators, restaurants and shops whose business models assume current volumes.

Visitor dissatisfaction and reputational damage: Travellers who plan expensive trips only to find key sites closed, fully booked or prohibitively priced become vocal critics. Negative reviews and social media complaints damage destination reputation and shift demand to equally fragile alternative locations.

Displacement without substitution: Restricting access to Site A often redirects visitors to Site B without reducing overall pressure on the destination system. The problem moves rather than resolves. Research on visitor displacement in protected areas shows that simple restrictions rarely achieve intended conservation outcomes unless coupled with attractive alternatives (protected area management effectiveness study).

Loss of educational opportunity: When destinations limit access before visitors understand why protection matters, rules feel arbitrary rather than logical. This undermines long-term support for conservation and breeds resentment among both visitors and local tourism operators.

Reframing overtourism as experiential design challenge

If the core problem is concentrated demand for specific experiences at specific sites, the solution requires redesigning the experience architecture. Immersive gateways do exactly this.

Rather than restricting physical access to the Rialto Bridge or the Santorini sunset viewpoint, a gateway at the ferry terminal or cruise port offers visitors an emotionally satisfying encounter with the destination narrative before they ever enter the historic core. A 20-minute fulldome experience showing Venice's lagoon ecosystem, architectural evolution and climate vulnerability can:

Satisfy visual curiosity: High-resolution, immersive content delivers the "Instagram moment" without physical presence at the crowded spot

Redistribute dwell time: Visitors spend 20-30 minutes in the gateway venue rather than all of it in the historic centre

Prime behavioural intentions: Understanding fragility before entering streets makes navigation rules and capacity limits feel necessary rather than arbitrary

Create year-round anchor attraction: Gateway venues operate 365 days, smoothing seasonal peaks and generating consistent revenue during off-peak periods

This is not theory. Studies on immersive tourism experiences demonstrate that well-designed spatial environments increase visitor engagement and support more sustainable behavioural choices when properly framed (immersive tourism sustainability research).

Research on augmented reality in heritage attractions shows similar effects: technology-mediated experiences can deliver satisfaction comparable to physical site visits while dramatically reducing environmental impact per visitor (AR and sustainable heritage study).

The shift from restriction-based to design-based overtourism management represents a fundamental strategic evolution. Destinations move from reactive damage control to proactive experience architecture.

How immersive gateways reduce physical impact while increasing revenue

The financial sustainability of overtourism solutions matters as much as their ecological effectiveness. Immersive gateways address both simultaneously.

Revenue model: high-volume, high-margin, low-impact

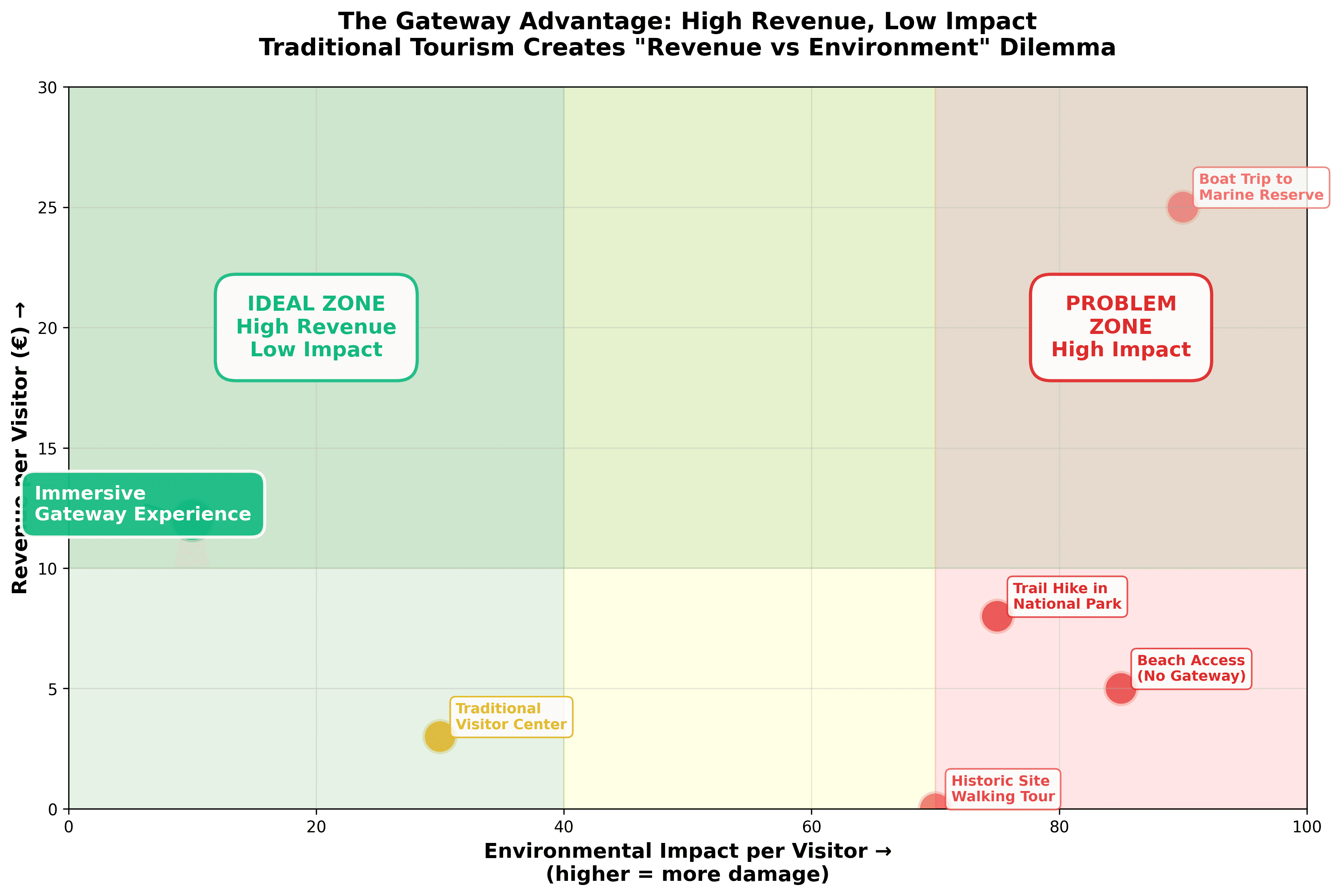

The gateway advantage: Immersive gateway experiences generate €12 per visitor with minimal environmental impact (score: 10/100), occupying the ideal high-revenue/low-impact zone. Traditional tourism activities force destinations into revenue-vs-environment trade-offs, with beach access, boat trips and trail hikes generating high environmental costs. Chart based on comparative impact assessments across destination types.

Immersive gateway venues operate on fundamentally different economics than traditional tourism infrastructure.

Ticket revenue at scale: A 16-metre diameter fulldome theatre can accommodate 80-120 visitors per 20-minute show. Operating 8 shows per hour during peak periods and 4 shows per hour in shoulder seasons, a single venue at a high-traffic gateway (ferry terminal, cruise port, airport arrival area) can serve 200,000 to 500,000 visitors annually.

At €10-12 average ticket price – either sold directly or bundled into ferry tickets, cruise shore excursion packages or multi-attraction passes – gross annual revenue ranges from €2 million to €6 million per venue. Operating costs typically run 25-35% of gross revenue, including staff, content production, utilities, maintenance and licensing. This produces EBITDA margins of 65-75%, with capital payback periods of 12-24 months in high-throughput locations (unit economics documentation).

Comparative impact per euro: Traditional tourism revenue generation requires physical presence at accommodation, restaurants, retail and attractions. Each euro of spending carries associated environmental costs: water consumption, waste generation, transport emissions, infrastructure wear, ecosystem disturbance.

Gateway venues concentrate revenue generation in controlled environments. One hundred visitors spending 20 minutes in a fulldome theatre generate equivalent ticket revenue to those same visitors spending 2-3 hours in a heritage site or beach area, but with dramatically lower:

Physical footprint (compact venue vs dispersed site access)

Waste generation (centralised facilities vs distributed littering)

Ecosystem contact (zero habitat disturbance vs trail erosion, wildlife stress, coral damage)

Infrastructure pressure (purpose-built venue vs historic buildings, fragile pathways)

Ancillary revenue opportunities: Beyond ticket sales, gateway venues generate additional income through:

Content licensing to other venues (same show licensed to 5-10 locations multiplies production investment returns)

Merchandise and educational materials (books, media, locally-sourced products)

Corporate sponsorship aligned with conservation (transport operators, equipment manufacturers, sustainability-focused brands)

Event space rental during off-peak hours (conferences, film screenings, educational programmes)

Premium experiences (private bookings, extended content, backstage access to production)

Operational flexibility: scalable, adaptable, future-proof

Unlike fixed infrastructure such as hotels, marinas or mountain lifts, immersive venues offer unusual flexibility.

Modular deployment: Fulldome theatres range from 12-metre portable installations to 25-metre permanent structures. Destinations can start with a single gateway at the highest-pressure entry point, validate the model and expand to secondary locations using proven content and operational systems. This staged approach reduces initial capital requirements and political risk.

Content reprogramming: The same physical infrastructure can host multiple storylines rotated seasonally, updated as conditions change or customised for different audience segments (school groups, cruise passengers, adventure travellers, luxury tourists). This adaptability is impossible with static museum exhibits or fixed attraction infrastructure.

When Venice's lagoon ecosystem responds to climate interventions, content updates in weeks rather than requiring years of construction. When Maya Bay reopens after reef rehabilitation, the gateway show evolves immediately to reflect new conservation protocols.

Technology refresh cycles: Projection systems, audio equipment and interactivity platforms evolve on 5-7 year cycles. Unlike building renovations that require major permits and disruption, technology upgrades happen during brief maintenance windows. The venue infrastructure remains while the experience quality improves continuously.

Multi-season activation: Gateway venues operate year-round, providing anchor attractions during off-peak months when traditional outdoor experiences are weather-constrained or ecologically sensitive (nesting seasons, coral spawning, extreme weather). This smooths destination revenue across seasons and reduces the pressure to concentrate earnings into narrow peak windows.

Measuring impact: metrics that matter to authorities and investors

Effective overtourism management requires quantifiable results. Immersive gateway performance can be tracked across multiple dimensions:

Physical pressure reduction: |

|---|

Percentage decrease in dwell time at most sensitive sites

|

Behavioural compliance: |

|

Economic performance: |

Gateway ticket revenue vs baseline tourism spending

|

Visitor satisfaction: |

Repeat visitation rates

|

Community acceptance: |

Resident surveys on tourism impacts and support for management interventions

|

The Immersive Destination Analysis dataset provides frameworks for tracking these metrics systematically. Destinations implementing gateway strategies should establish baseline measurements before launch and conduct regular assessments to demonstrate effectiveness to stakeholders and refine operations.

Case scenarios: Gateway strategies for different overtourism patterns

Overtourism manifests differently across destination types. Gateway strategies adapt accordingly.

Island destinations with concentrated ferry access

Pattern: All visitors arrive by sea through 1-3 primary ports. Seasonal peaks create extreme congestion. Limited land area constrains dispersion options. Marine ecosystems highly vulnerable to visitor pressure.

Examples: Santorini (Greece), Capri (Italy), Galápagos Islands (Ecuador), Phi Phi Islands (Thailand), smaller Mediterranean and Caribbean islands.

Gateway strategy: Place primary fulldome theatre at main ferry terminal, integrated into passenger flow before disembarkation. Ticket bundled into ferry fare or sold as mandatory component of island entry (where regulatory frameworks allow). Content focuses on:

Marine ecosystem fragility (coral reefs, seagrass beds, nesting beaches)

Island carrying capacity and why it exists

Alternatives to overcrowded hotspots

Behavioural protocols for beach access, wildlife encounters, waste management

Impact mechanism: Every arriving visitor experiences 15-20 minute immersive preparation before setting foot on the island. Those with limited time (day trippers, cruise passengers on tight schedules) can choose gateway-only visit, satisfying destination experience without physical island access. Longer-stay visitors arrive pre-educated, reducing interpretation burden on park rangers and guides.

Revenue model: Ferry terminal gateways capture near-100% of arriving visitors. At 200,000-500,000 annual arrivals (typical for mid-sized island destinations), €10-12 gateway tickets generate €2-6 million gross annual revenue. Revenue sharing between ferry operator, port authority and destination management organisation aligns incentives. Capital investment (€1-1.5 million for 16m dome including content) paid back in 12-18 months.

The Galápagos Islands profile in the Immersive Destination Analysis dataset illustrates this pattern: approximately 97% protected land area with all visitor flows concentrated through a handful of gateway points. A gateway at the main harbour or airport could reach nearly every visitor before dispersal across islands.

Heritage cities with cruise passenger surges

Pattern: Historic urban cores experience massive daily influx from cruise ships. Passengers concentrate visits into 4-8 hour windows. Narrow streets and fragile buildings overwhelmed. Residents and long-stay tourists displaced. Economic benefits accrue primarily to cruise lines rather than local businesses.

Examples: Venice (Italy), Dubrovnik (Croatia), Barcelona (Spain), Kotor (Montenegro), smaller Adriatic and Baltic port cities.

Gateway strategy: Construct fulldome venue at cruise terminal or within 5-minute walk of disembarkation point. Content showcases city history, architectural significance, climate vulnerability and sustainable exploration options. Experience designed as emotional anchor that reduces urgency to "see everything" in limited time. Partner with cruise lines to pre-sell gateway tickets as shore excursion premium upgrade.

Impact mechanism: Cruise passengers choosing gateway experience (20-30 minutes) plus targeted exploration of 1-2 key sites distribute pressure more evenly than hordes rushing to photograph the same 3 landmarks. Gateway becomes anchor attraction that cruise itineraries market as "exclusive access to immersive city narrative." This reframes the destination experience: understanding over checklist completion.

Revenue model: Large cruise vessels carry 2,000-6,000 passengers. Assume 30-50% gateway participation (conservative, given captive audience and short shore time). At 150 ships per season (typical for major Mediterranean ports), gateway serves 90,000-450,000 passengers. Premium pricing for cruise passengers (€15-20 vs €10-12 general admission) reflects convenience and bundled shore excursion positioning. Annual revenue: €1.5-9 million depending on vessel size and participation rates.

Partnership structures where cruise lines co-invest in gateway development (seeking differentiated shore experiences) can reduce destination capital requirements. Operators gain exclusive content licensing; destinations gain pressure relief and revenue share.

Coastal destinations with beach and reef pressure

Pattern: Tourism concentrated on handful of beaches and dive sites. Coral bleaching, turtle nesting disruption, coastal erosion from overuse. Limited alternative attractions. High seasonal variance. Marine protected areas with insufficient enforcement capacity.

Examples: Maya Bay (Thailand), Great Barrier Reef zones (Australia), Maldives resort islands, Caribbean dive destinations, Mediterranean beach clusters.

Gateway strategy: Position underwater-themed flying theatre or fulldome experience at primary beach access points, dive centre hubs or resort welcome centres. Content immerses visitors in reef ecosystems, showing seasonal phenomena (coral spawning, turtle nesting, fish breeding cycles) that physical snorkelling cannot reliably reveal. Emphasise fragility of marine life and consequences of poor visitor behaviour (sunscreen chemicals, coral contact, feeding fish).

Impact mechanism: Visitors who experience immersive reef encounters arrive at actual dive sites with different mindsets: understanding rather than entitlement. Many (especially non-swimmers, families with young children, elderly travellers) may choose gateway-only marine experience, reducing physical dive site pressure. Those who do snorkel or dive comply better with protocols (no coral touching, proper buoyancy, wildlife distance) because they understand ecosystem vulnerability emotionally, not just intellectually.

Revenue model: Beach and dive destinations often already charge park entry fees (€5-10). Gateway tickets (€10-15) represent modest incremental cost but deliver dramatically enhanced experience value. At destinations with 150,000-300,000 annual visitors, gateway revenue of €1.5-4.5 million offsets costs while directly funding marine conservation (portion of ticket revenue dedicated to reef restoration, ranger patrols, research monitoring).

Studies on marine protected area management show that visitor education programmes improve compliance with conservation rules and reduce ecosystem impacts when programmes are experiential rather than informational (MPA visitor education effectiveness). Immersive gateways represent the most sophisticated evolution of this approach.

Mountain and wilderness destinations with trail concentration

Pattern: Visitor pressure concentrated on handful of iconic trails and viewpoints. Erosion, vegetation loss, wildlife disturbance. Parking and access infrastructure at capacity. Seasonal closures disrupt tourism economy.

Examples: National parks with star attractions (Grand Canyon overlooks, Yosemite Valley, Torres del Paine), alpine villages, glacier access points.

Gateway strategy: Develop immersive visitor centre at park entrance or nearby transport hub. Content combines ecological interpretation with virtual access to closed or restricted areas. During wildlife breeding seasons or extreme weather, gateway becomes primary visitor experience while physical trails close. Off-season, gateway provides year-round attraction when trails are snow-covered or dangerous.

Impact mechanism: Visitors satisfied by immersive encounters with wildlife, geological processes and seasonal phenomena may reduce physical trail time or choose less-impacted alternative routes. Gateway becomes tool for dynamic visitor flow management: promote specific trails or zones in real-time based on current conditions and congestion.

Revenue model: National park entrance fees typically €10-25. Gateway admission (bundled or separate) adds €8-15. High-volume parks (500,000+ annual visitors) generate €4-7.5 million gateway revenue. Lower-volume but high-value destinations (100,000 visitors at €20+ gateway premium) generate €2+ million. Revenue funds trail maintenance, ranger staffing and ecosystem restoration.

Financial structures and partnership models for overtourism contexts

Overtourism destinations often have complex stakeholder landscapes. Gateway financing must navigate this.

Public-private partnerships in high-visibility contexts

Heritage cities and protected areas managed by public authorities typically require partnership structures that balance commercial efficiency with public accountability.

Concession model: Destination authority (national park service, municipal tourism board, port authority) retains land ownership and policy control. Private operator (specialised gateway developer like Origin of Wonder, entertainment infrastructure company, or local consortium) builds and operates venue under 15-25 year concession.

Structure includes:

Minimum guarantee payments to authority (fixed annual fee or percentage of gross revenue, whichever higher)

Performance metrics tied to visitor satisfaction, conservation outcomes, resident acceptance

Content approval authority retained by destination (ensuring narrative accuracy and cultural sensitivity)

Profit-sharing above agreed thresholds

Asset transfer to public ownership at concession end

This model allows destinations to gain infrastructure without upfront capital while maintaining oversight. Private operators gain long-term revenue security justifying initial investment.

Transport operator integration for islands and cruise destinations

Ferry companies, cruise lines and shuttle operators have strong incentives to co-invest in gateway infrastructure that differentiates their services and reduces destination backlash against overcrowding.

Bundled service model: Transport operator finances gateway as amenity bundled into ticket price. Venice-Santorini ferry passengers receive gateway experience as part of journey, marketed as "Immersive Destination Introduction" or similar. Cruise lines position gateway as exclusive shore excursion not available to general public.

Structure includes:

Operator finances construction (€1-1.5 million typical) and content production (€300-500k)

Gateway operated by destination authority or joint venture

Operator receives preferential booking access and co-branding rights

Revenue split reflects capital contribution

Multi-year operating agreement provides payback certainty

This alignment transforms gateway from cost centre for destination into revenue and differentiation opportunity for transport operator. Political benefits accrue to destinations (reducing cruise/ferry criticism without banning ships) while operators gain marketing assets.

Conservation finance blended structures

Destinations where overtourism threatens critical ecosystems can attract conservation-oriented capital alongside commercial investment.

Impact investment + philanthropic co-funding: Structure combines:

Commercial investment (40-60% of capital) seeking financial returns at market or near-market rates

Conservation foundation grants (20-30% of capital) supporting environmental outcomes

Destination authority contribution (10-30%) in land, permits, co-marketing

Community benefit commitments (local employment, procurement, revenue sharing with indigenous groups)

The Immersive Investors dataset (raw JSON, README) profiles 45 investors and related entities, with approximately one-third positioning explicitly as impact funds, development finance institutions or hybrid vehicles with strong sustainability mandates. Several consistently highlight ocean and coastal agendas, creating natural alignment with marine overtourism contexts.

Returns structured to satisfy diverse capital: commercial investors receive debt service or equity returns from operating cash flows; foundation funders receive conservation impact metrics and research access; destinations receive pressure relief and enhanced reputation; communities receive employment and capacity building.

Revenue allocation frameworks that build political support

Gateway success in overtourism contexts depends on broad stakeholder acceptance. Revenue allocation mechanisms build coalitions:

Multi-beneficiary split:

30-40%: Gateway operating costs (staff, content updates, maintenance, marketing)

20-30%: Destination conservation fund (habitat restoration, ranger capacity, research monitoring)

15-25%: Community benefit fund (local employment, cultural programmes, resident services)

10-15%: Infrastructure maintenance (trails, public facilities, transport improvements)

5-10%: Destination marketing authority (promoting gateway as sustainable tourism model)

Transparent allocation with regular public reporting demonstrates that gateway revenue serves broad destination benefit, not narrow commercial extraction. This builds resident support (seeing direct community investment) and operator acceptance (recognising their role in sustainable funding model).

Implementation pathway for overtourism destinations

Destinations considering gateway strategies follow systematic assessment and deployment.

Phase 1: Baseline assessment and stakeholder mapping (2-3 months)

Quantify current overtourism impacts:

Visitor concentration mapping (where/when pressure peaks)

Ecological damage documentation (habitat condition assessments, wildlife stress indicators)

Infrastructure strain measurement (transport congestion, public facility overload)

Resident sentiment surveys (tourism acceptance scores, quality of life impacts)

Economic dependency analysis (which businesses/communities rely on current flows)

Identify gateway locations: Apply location selection framework from gateway location selection methodology to identify 2-4 candidate sites. Prioritise locations with:

Highest visitor throughput (ferry terminals, cruise ports, primary entry points)

Timing before sensitive site access (preparation rather than reflection)

Infrastructure readiness (existing buildings, utilities, access)

Stakeholder alignment (port authorities, transport operators supportive)

Engage stakeholder ecosystem:

Destination management organisations and tourism boards

Environmental protection authorities and park services

Transport operators (ferries, cruise lines, shuttle companies)

Hospitality sector representatives (hotels, tour operators)

Resident associations and community leaders

Conservation NGOs and research institutions

Establish working group with multi-stakeholder representation to oversee assessment and provide input on gateway strategy.

Phase 2: Feasibility study and business model (3-4 months)

Technical feasibility:

Site surveys for selected gateway locations (structural capacity, utilities, permitting requirements)

Content development scope (storylines, production requirements, local partnerships)

Technology specifications (dome size, projection systems, audio/interactivity platforms)

Regulatory pathway (building permits, environmental assessments, heritage approvals)

Financial modelling: Build detailed projections with conservative/expected/optimistic scenarios:

Capital requirements (construction, equipment, content production, pre-opening expenses)

Operating costs (staff, utilities, maintenance, marketing, licensing, insurance)

Revenue assumptions (visitor numbers, participation rates, ticket pricing, ancillary income)

Sensitivity analysis (impact of lower participation, seasonal variance, economic downturns)

Payback period and return on investment calculations

Partnership structure design: Based on stakeholder engagement, develop preferred governance and financial arrangements:

Public-private partnership terms (if applicable)

Transport operator integration (bundled vs standalone pricing)

Revenue allocation formula (operating costs, conservation fund, community benefits)

Performance metrics and reporting requirements

Phase 3: Funding and partnership agreements (4-6 months)

Capital sourcing: Pursue combinations of:

Municipal or regional tourism development funds

National park or environmental infrastructure budgets

Transport operator co-investment (ferries, cruise lines)

Impact investment funds focused on sustainable tourism (Immersive Investors network)

Conservation foundation grants (for destinations with high ecological significance)

Development bank or multilateral financing (World Bank, regional development banks)

Partnership finalisation: Negotiate and execute agreements covering:

Land tenure and usage rights (lease, concession, purchase)

Governance structure (oversight board, operating authority, decision rights)

Revenue sharing and financial obligations (minimum guarantees, profit splits)

Performance standards (visitor satisfaction, conservation outcomes, community benefits)

Dispute resolution and exit mechanisms

Regulatory approvals: Secure necessary permits:

Building and construction approvals

Environmental impact assessment (if required)

Heritage site permissions (for locations in protected zones)

Business licensing and operational permits

Transport integration agreements (ferry ticket bundling, cruise shore excursion status)

Phase 4: Design, construction and content production (8-12 months)

Infrastructure development:

Detailed architectural and engineering design

Procurement of projection systems, audio equipment, seating, environmental controls

Site preparation and renovation (if adapting existing buildings)

Dome structure installation and integration

Technology commissioning and testing

Content creation:

Storyline development with local experts, scientists, cultural advisors

Filming and production (drone footage, underwater cinematography, time-lapse, CGI)

Narrative scripting and localisation (multiple language versions)

Audio design and musical composition

Interactivity programming (if applicable)

Quality testing with focus groups

Operational preparation:

Staff recruitment and training (operators, guides, ticketing, technical support)

Booking system integration (online platforms, transport operator systems, visitor centre coordination)

Marketing campaign development (pre-launch awareness, media relations, influencer partnerships)

Standard operating procedures (show scheduling, maintenance protocols, emergency procedures)

Phase 5: Launch and optimisation (6-12 months post-opening)

Soft opening: Invite stakeholders, media, resident groups and selected visitors for preview experiences. Gather feedback on:

Content effectiveness (emotional impact, educational clarity, cultural authenticity)

Operational smoothness (ticketing, flow management, technical reliability)

Visitor satisfaction (net promoter scores, qualitative responses)

Integration with wider destination (transport connections, multi-attraction packages)

Public launch: Coordinate opening with:

Major tourism trade shows or events (leverage media attention)

Destination marketing campaigns (position gateway as sustainable tourism leadership)

Transport operator promotions (cruise lines, ferry companies marketing bundled experiences)

Conservation partnerships (announce gateway revenue dedication to protection funds)

Performance monitoring and iteration: Track metrics established in Phase 1:

Visitor throughput and participation rates

Revenue performance vs projections

Impact on physical site pressure (dwell time changes, behavioural compliance)

Visitor and resident satisfaction scores

Media coverage and destination reputation effects

Refine operations based on data:

Adjust show schedules for optimal capacity utilisation

Update content based on visitor feedback and seasonal conditions

Optimise pricing and packaging (bundled tickets, premium tiers, group discounts)

Expand marketing to higher-conversion channels

Phase 6: Expansion and replication (Year 2-3)

Secondary gateway development: After validating first gateway, consider:

Additional locations at secondary entry points (regional airports, smaller ports, shuttle hubs)

Different content focusing on alternative destination aspects (specific ecosystems, historical periods, cultural traditions)

Seasonal variations (summer vs winter storylines, breeding season vs migration content)

Content licensing: Leverage production investment by licensing shows to:

Other overtourism destinations facing similar challenges (Mediterranean islands, Caribbean dive sites)

Feeder market venues (aquariums, science centres, tourism expos in origin countries)

Educational institutions (marine biology programmes, sustainable tourism curricula)

Network effects: As multiple destinations adopt gateway strategies, create:

Shared content library (reducing per-destination production costs)

Operational best practices exchange (cross-destination learning)

Joint marketing ("immersive gateway network" positioning for sustainable tourism segment)

Collaborative research (measuring impact across destinations, publishing peer-reviewed studies)

Destination managers seeking structured support through this pathway can work with Origin of Wonder, which provides turnkey gateway development from feasibility assessment through launch and ongoing optimisation (explore partnership opportunities).

Why immersive gateways succeed where other over-tourism interventions fail

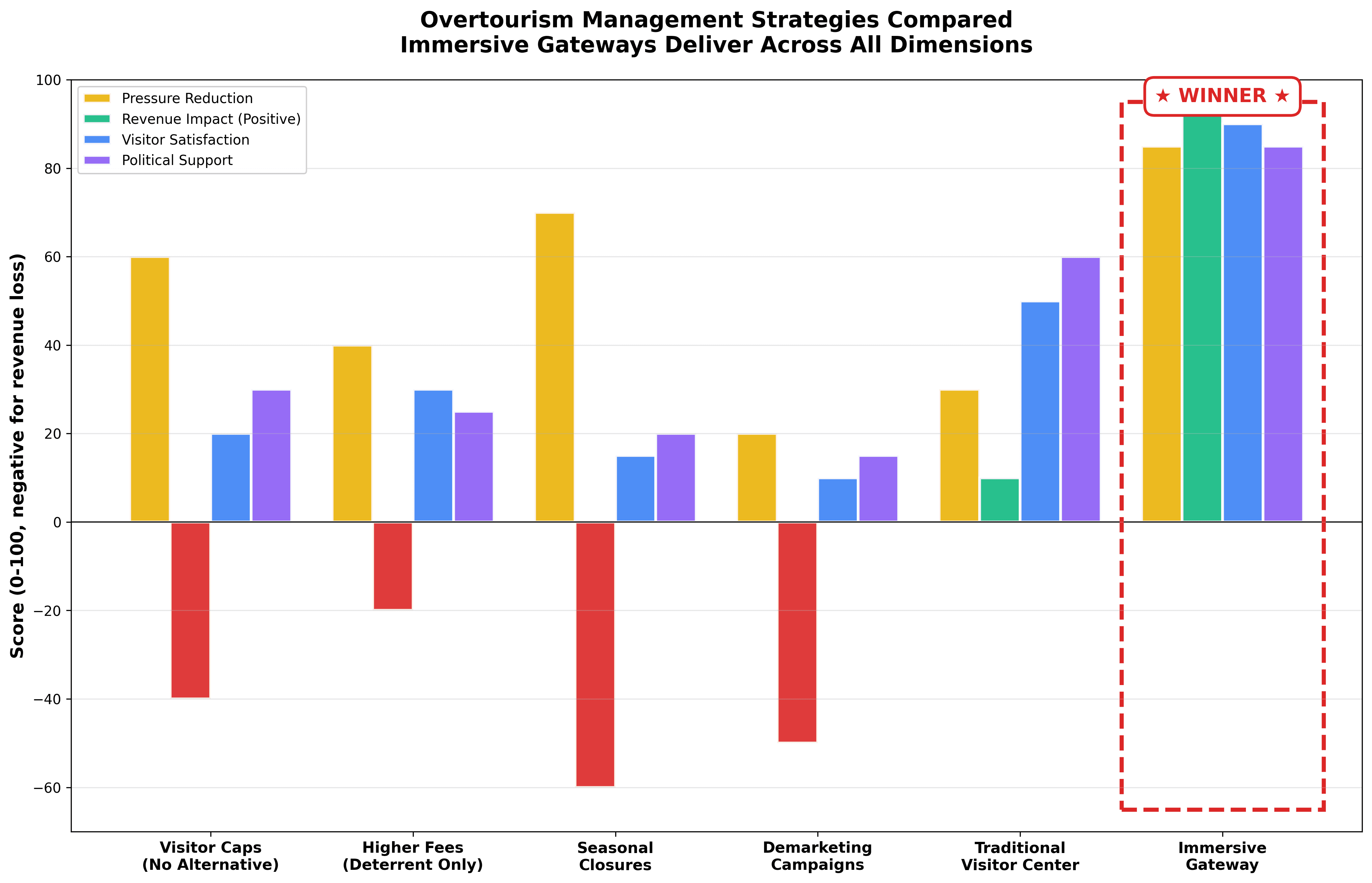

Comparative analysis of overtourism management strategies across four critical dimensions. Immersive gateways uniquely deliver on all measures: reducing physical pressure while generating positive revenue, maintaining visitor satisfaction and building political support. Traditional restriction-based strategies sacrifice revenue and satisfaction; conventional visitor centers fail to achieve meaningful pressure reduction.

Reflecting on patterns across dozens of overtourism management efforts reveals why many interventions fall short – and why gateway strategies address root causes.

Traditional failures: Misaligned incentives and missing alternatives

Visitor caps without substitution: Limiting daily visitors to a heritage site or beach reduces immediate pressure but leaves would-be visitors frustrated, operators revenue-deprived and communities economically vulnerable. Caps work only when coupled with attractive alternatives that satisfy visitor desires and maintain economic flows.

Higher fees as deterrent: Pricing strategies that raise entrance fees to reduce demand typically fail because: (1) wealthy visitors absorb increases, displacing budget travellers but not reducing pressure, (2) residents perceive exploitation ("profiting from our heritage"), (3) operators resist if fees accrue to authorities rather than businesses.

Demarketing campaigns: "Please don't visit" messaging generates backlash (residents: "we need tourism income"; operators: "you're destroying our livelihoods") and rarely deters committed travellers who have already booked flights and accommodation. Messaging that warns without offering alternatives becomes noise.

Seasonal restrictions: Closing sites during peak breeding, nesting or cultural events protects ecosystems but concentrates pressure into remaining periods and fails to address shoulder-season management needs.

None of these create the thing overtourism destinations actually need: high-quality, satisfying experiences that operate in parallel to physical site access, redirect some demand, prepare all visitors and generate revenue that funds protection.

Gateway advantages: Structural alignment and multiple benefits

Incentive alignment across stakeholders:

Visitors get meaningful experiences that satisfy curiosity and create memories

Operators gain differentiated offerings that command premium pricing

Transport companies integrate gateways as service upgrades that reduce destination conflicts

Destinations achieve pressure relief, revenue generation and conservation funding simultaneously

Communities see employment, cultural representation and direct benefit from tourism

Substitution with satisfaction: Research on protected area management demonstrates that effective alternatives must meet visitor motivations, not just provide generic diversions (visitor experience substitution study). Immersive gateways satisfy the core desires – seeing iconic places, understanding significance, creating shareable experiences – through spatial storytelling that feels authentic rather than compensatory.

Economic sustainability without extraction: Gateway revenue flows continuously (year-round operation smooths seasonal variance), scales with demand (more visitors = more tickets without proportional cost increases) and generates surplus for reinvestment. Unlike traditional tourism where margin accrues primarily to external operators (cruise lines, international hotel chains), gateway economics favour destination capture.

Behavioural change infrastructure: Environmental interpretation research consistently shows that pre-experience education influences behaviour more effectively than post-visit messaging (interpretation timing effects). Gateways literally place education infrastructure where it matters most: before visitors access sensitive sites.

Political resilience: Gateway strategies build multi-stakeholder coalitions. Residents support infrastructure that generates community benefits while reducing pressure. Operators support offerings that enhance business models. Environmentalists support solutions that demonstrably reduce impacts. This coalition structure survives political transitions and economic cycles better than top-down restrictions.

Adaptive capacity: Content updates allow gateways to respond to changing conditions (climate impacts, species recovery, new research findings, cultural events) without infrastructure reconstruction. Seasonal programming keeps experiences fresh for repeat visitors. Multi-language options and accessibility features (audio description, sensory-friendly shows) broaden appeal.

Measurement and validation: Unlike vague sustainability commitments, gateway effectiveness can be tracked through quantifiable metrics: visitor throughput, revenue performance, site pressure changes, behavioural compliance rates, resident sentiment scores. This data proves value to sceptics and guides continuous improvement.

Addressing objections and implementation concerns

Destination managers considering gateway strategies raise predictable concerns. Most have evidence-based responses.

"Our visitors want authentic experiences, not artificial substitutes"

Response: Immersive gateways do not replace authentic encounters – they prepare and enhance them. Research demonstrates that interpretation which provides emotional and intellectual context increases satisfaction with subsequent site visits (contextual interpretation impact).

The gateway-then-site sequence parallels museum practice: visitors who first encounter historical context in an exhibition hall experience artefacts more deeply than those confronting objects cold. Similarly, visitors who understand Venice's lagoon engineering or Santorini's volcanic geology through immersive narrative engage more meaningfully with physical spaces.

Moreover, "authenticity" increasingly includes technology-mediated experiences. Younger visitors in particular expect digital interpretation, interactive elements and immersive media as integral components of cultural and natural heritage engagement (millennials and heritage technology).

"We lack capital for major infrastructure investment"

Response: Gateway capital requirements (€1-1.5 million typical for mid-sized installations) are modest compared to alternative overtourism interventions: new transport infrastructure, accommodation construction, heritage site restoration or expanded public facilities often cost 5-10x more while failing to address core pressure dynamics.

Financing structures described earlier – public-private partnerships, transport operator co-investment, impact investment with blended capital – distribute costs across beneficiaries. Destinations rarely need full upfront capital. The Immersive Investors dataset maps capital sources specifically interested in sustainable tourism infrastructure.

Moreover, 12-24 month payback periods mean gateways become cash-flow positive quickly, funding expansion without additional capital calls.

"Local operators will resist anything that reduces visitor access"

Response: Gateway strategies do not reduce access – they redistribute and prepare flows. Operators benefit from:

Longer average visitor stays (gateway adds attraction, encouraging multi-day rather than day-trip patterns)

Higher visitor satisfaction (better-prepared, less-frustrated visitors spend more and return more often)

Year-round demand smoothing (gateways operate off-season, supporting businesses during slow periods)

Reduced political backlash (gateways address resident complaints, protecting tourism's social licence)

Engagement processes during Phase 1-2 should demonstrate these benefits explicitly. Co-branding opportunities (tour operators featured in gateway content, restaurants offered package deals, hotels receiving booking commissions) align incentives.

Cases where operators initially resist gateway proposals typically reflect poor communication of benefits or exclusion from planning processes. Multi-stakeholder governance addresses this.

"Our destination's character is unique – generic solutions won't work"

Response: Gateway infrastructure is modular and standardised (projection domes, flying theatres, audio systems). Content is entirely custom. This separation allows destinations to deploy proven technology while telling locally specific stories shaped by indigenous knowledge holders, resident artists, historians and scientists.

The immersive-destination-marketing dataset (methodology) documents diversity across 88 destinations – coastal/inland, tropical/temperate, islands/cities, marine/terrestrial, indigenous/settler – all potentially served by gateway approaches adapted to local context.

Customisation happens where it matters (narrative authenticity) while leveraging economies of scale where appropriate (technology platforms, operational systems, financing structures).

"Residents will perceive gateways as further commercialisation of heritage"

Response: Resident acceptance depends on process and benefit distribution. When gateways:

Involve residents in content creation (capturing local stories, employing local guides and artists)

Dedicate revenue shares to community benefit funds (visible local improvements)

Demonstrably reduce negative impacts (less crowding, better visitor behaviour, cleaner public spaces)

Operate transparently (public reporting on finances and outcomes)

...residents perceive them as protective infrastructure rather than extractive commercialisation.

Barcelona's resident opposition to tourism often centres on feeling that outsiders profit while locals endure costs. Gateways that flip this equation – generating revenue that funds resident services while reducing pressure – shift political dynamics.

Case studies from marine protected areas show that tourism infrastructure with clear conservation linkages gains community support when benefits and decision-making authority are genuinely shared (community-based marine tourism).

Data resources for overtourism assessment and gateway planning

Effective implementation requires systematic destination analysis. The following open datasets provide foundations:

Immersive Destination Analysis dataset Profiles 88 tourism and investment destinations with particular attention to overtourism signals, protected area concentrations and sustainability pressure indicators. Approximately 37% of profiled destinations show explicit overtourism patterns.

Immersive-destination-marketing dataset Underlying dataset with detailed destination and attraction profiles. Tracks 75 attractions across 88 destinations, documenting concentration patterns, protected area ratios and tourism dependency.

Immersive Investors dataset Maps 45 investors and related entities, with approximately one-third explicitly focused on impact investment combining tourism, conservation and community development objectives.

These datasets are maintained as open resources to support evidence-based destination management decision-making.

Frequently Asked Questions

What makes immersive gateways different from virtual reality or other technology solutions?

Immersive gateways use proven, group-based technology platforms (fulldome theatres, flying theatres, projection-mapped spaces) that accommodate 80-150 visitors per show rather than individual VR headsets serving one person at a time. This group format creates shared experiences that enhance social aspects of travel while achieving the throughput necessary for financial sustainability at destination scale.

Unlike VR which can feel isolating and "fake," spatial environments with high-resolution real footage, accurate scientific content and cinematic production values deliver authentic emotional engagement. Studies comparing immersive media formats show that shared spatial experiences in dome theatres produce stronger presence effects and emotional responses than individual VR for many content types (dome vs VR comparison).

Gateway infrastructure is also more robust and maintainable than consumer VR equipment. Technology refresh cycles happen on predictable timelines without daily hardware failures that plague VR headset operations in high-traffic public venues.

How do gateways avoid simply adding to overtourism by attracting more visitors?

Gateway strategies are designed for destinations already experiencing overtourism – places where demand exceeds supply. The goal is not to grow total visitor numbers but to redesign how existing visitors experience the destination.

In practice, gateways serve multiple functions:

Substitution for some visitors: Those with limited time, physical constraints or preferences for mediated experiences choose gateway-only visits, reducing physical site pressure

Preparation for most visitors: Even those proceeding to physical sites arrive better educated, reducing problematic behaviours

Temporal redistribution: Year-round gateway operations smooth seasonal peaks by providing compelling off-season attractions

Spatial redistribution: Content can highlight alternative sites and experiences, drawing visitors away from most-pressured hotspots

Monitoring systems established during implementation track these effects. If gateways were generating net increases in total visitors rather than redistributing existing demand, adjustments to marketing positioning and content would address this.

What evidence exists that immersive experiences actually change visitor behaviour?

Multiple research streams demonstrate behavioural effects:

Interpretation timing studies show that pre-visit education influences actions more effectively than post-visit messaging. Visitors who understand ecosystem fragility before entering trails exhibit better compliance with marked paths, wildlife distance rules and waste disposal protocols (interpretation effectiveness meta-analysis).

Immersive media impact research finds that spatial storytelling formats produce stronger emotional engagement and pro-environmental intentions than conventional media. Studies on immersive exhibitions in museums and visitor centres document measurable increases in conservation knowledge and stated willingness to adopt sustainable behaviours (immersive interpretation outcomes).

Protected area education programme evaluations demonstrate that well-designed visitor education reduces measurable environmental impacts (trail erosion, wildlife disturbance, littering) when programmes are experiential, values-aligned and delivered before site access (USGS education effectiveness review).

Gateway developers should establish pre/post measurement frameworks tracking specific behaviours: percentage staying on marked trails, wildlife distance compliance, participation in voluntary conservation programmes, social media posts reflecting understanding vs exploitation framing.

How quickly can gateways be developed and become operational?

Timeline depends on regulatory environment, site complexity and partnership negotiation duration. Typical phases:

Feasibility and planning: 3-6 months

Funding and approvals: 4-8 months

Design and construction: 8-12 months

Content production: 6-10 months (can overlap with construction)

Launch and optimisation: 2-3 months

Total: 18-30 months from initial assessment to full operation.

Destinations with strong institutional capacity, existing stakeholder alignment and available gateway sites (underutilised port buildings, visitor centre expansions) can compress timelines. Complex contexts requiring extensive environmental assessments, heritage permissions or community consultation processes extend them.

Modular dome installations can sometimes achieve faster deployment than permanent structures if permitting frameworks allow temporary or mobile installations as proof-of-concept before committing to fixed infrastructure.

What happens if visitor numbers decline or shift away from our destination?

Gateway financial models should be stress-tested for demand sensitivity. Mitigation strategies include:

Revenue diversification:

Serve both tourists and residents (school groups, community events, corporate functions)

License content to other venues for recurring income independent of local visitor flows

Develop mobile or touring versions that generate revenue in feeder markets

Host private events and conferences during low-occupancy periods

Operational flexibility:

Variable staffing and show schedules (scale operations to actual demand)

Dynamic pricing (promotional rates during slow periods, premium pricing at peaks)

Content rotation (fresh programming encourages local repeat visits)

Strategic positioning:

Market gateway as reason to visit destination (becomes attraction that draws visitors rather than merely serving existing flows)

Emphasise off-season programming (gateway provides compelling year-round reason to travel)

Destinations experiencing visitor decline often have deeper issues (safety concerns, environmental degradation, economic crises, competitive destinations). In these contexts, high-quality gateway infrastructure can be part of recovery strategies that rebuild reputation and demonstrate renewed commitment to sustainability.

How do gateways integrate with existing destination management plans and policies?

Effective gateways align with and strengthen existing frameworks rather than operating independently.

Carrying capacity management: Gateways become tools for implementing capacity limits. Rather than simply turning visitors away when sites reach thresholds, destinations offer gateway alternatives that maintain satisfaction while enforcing protection. Real-time capacity monitoring can adjust gateway content to promote less-crowded alternatives.

Sustainable tourism certification and standards: Gateway development and operation can be structured to meet GSTC (Global Sustainable Tourism Council), EU Ecolabel or other certification criteria, strengthening destination sustainability credentials (GSTC destination criteria).

Climate action and adaptation plans: Gateways reduce per-visitor carbon intensity (less physical travel within destinations, more efficient visitor services concentration) and can be powered by renewable energy. Content addressing climate impacts builds public understanding and support for adaptation measures.

Community benefit frameworks: Revenue allocation to community funds, local employment targets and cultural representation in content creation align gateways with destination commitments to equitable tourism development.

UNESCO World Heritage management plans: For heritage sites, gateways can specifically address management plan requirements around visitor education, capacity management and community engagement. Several World Heritage Sites have incorporated immersive visitor centres as part of management strategies.

Can gateway strategies work for small destinations with limited budgets?

Scale-appropriate approaches exist:

Micro-gateways: Compact 8-10 metre domes or projection-mapped rooms serve 20-40 visitors per show. Capital costs (€300-500k) are accessible to smaller municipalities or community tourism initiatives. These installations still achieve meaningful throughput (50,000-100,000 annual visitors) while reducing physical impacts.

Content sharing cooperatives: Multiple small destinations facing similar overtourism challenges (Mediterranean islands, Caribbean dive sites, alpine villages) can co-develop content libraries, distributing production costs across 5-10 locations. Each destination customises 20-30% of content for local specificity while sharing core narrative and technical assets.

Phased deployment: Start with projection mapping in existing visitor centre spaces rather than purpose-built domes. Test content and visitor response. Use initial revenue to fund permanent infrastructure expansion. This staged approach reduces upfront risk while validating demand.

Mobile/touring formats: Portable dome installations can serve multiple small destinations on rotating schedules, bringing gateway experiences without requiring each location to invest in permanent infrastructure. Regional tourism boards or national park services can operate touring programmes serving distributed overtourism hotspots.

How do gateways address accessibility and inclusion?

Well-designed gateway venues offer superior accessibility compared to physical destination experiences:

Physical accessibility: Climate-controlled indoor environments with level access, wide aisles and accessible seating accommodate wheelchair users, mobility-impaired visitors and those with cardiovascular or respiratory conditions who cannot navigate trails, stairs or uneven terrain. This dramatically expands the visitor base who can meaningfully engage with destination narratives.

Sensory accommodations: Audio description tracks for vision-impaired visitors. Sensory-friendly shows with reduced stimulation for neurodivergent audiences. Hearing loop systems and closed captioning for deaf and hard-of-hearing visitors. These accommodations are infrastructure investments that serve permanently rather than requiring per-visit assistance.

Language and cultural accessibility: Multiple audio track options allow visitors to experience content in their native languages without the mediation loss of live interpretation. Cultural framing can adapt to different audience backgrounds (Western vs non-Western visitor knowledge assumptions) while maintaining scientific accuracy.

Economic accessibility: Tiered pricing (resident discounts, student/senior/child rates, family packages) makes gateways accessible across income ranges. Some destinations designate free access hours for local residents. This contrasts with boutique ecotourism solutions that serve only premium market segments.

Cognitive accessibility: Complex ecological or historical concepts are explained through visual metaphors, time-scale transitions and emotional narratives rather than technical jargon. This makes destination knowledge accessible to visitors without formal education in relevant fields.

What role can Origin of Wonder play in destination gateway development?

Origin of Wonder provides comprehensive gateway development services tailored to overtourism destination contexts:

Strategic planning and feasibility assessment:

Analysis of destination-specific overtourism patterns using systematic profiling methodologies

Gateway location selection applying multi-criteria frameworks

Financial modelling with conservative projections and sensitivity analysis

Stakeholder mapping and engagement strategy design

Regulatory pathway identification and risk assessment

Request a feasibility assessment to explore gateway potential for your destination.

Partnership and financing structuring:

Public-private partnership design (concession models, joint ventures, operating agreements)

Capital sourcing from impact investment networks mapped in the Immersive Investors dataset

Blended finance structuring (combining commercial capital, conservation funding and public investment)

Revenue allocation frameworks that build stakeholder coalitions

Content development and production:

Storyline development with local knowledge holders, scientists and cultural advisors

High-production-value filming (drone cinematography, underwater footage, time-lapse, CGI)

Multi-language audio production and cultural adaptation

Interactive element design and programming

Testing and iteration with focus groups

Technology integration and operations:

Procurement of projection systems, audio equipment and venue infrastructure

Installation oversight and commissioning

Operator training and standard operating procedure development

Booking system integration with transport operators and destination platforms

Ongoing technical support and content refresh cycles

Performance monitoring and optimisation:

Metrics framework design (tracking visitor satisfaction, behavioural outcomes, financial performance)

Data collection systems and reporting protocols

Continuous improvement processes responding to operational learnings

Expansion planning for secondary gateways and content licensing

Origin of Wonder partnerships are flexible, ranging from comprehensive turnkey development to targeted technical assistance, depending on destination capacity and preferences. Contact options and partnership models are detailed at destination partnership page.

Where can destination managers see existing immersive gateway examples?

While purpose-built overtourism gateways remain an emerging category, related precedents demonstrate proven technology and visitor acceptance:

Existing fulldome installations:

Numerous planetariums worldwide have expanded into nature and cultural content

Marine science centres and aquariums increasingly use domes for ocean storytelling

National park visitor centres (especially in North America) have integrated immersive theatres

Large-scale immersive projects: The Immersive Investors dataset documents flagship projects including coastal and island clusters in Saudi Arabia (Red Sea development), UAE (Yas Island complex) and other contexts where immersive infrastructure serves tourism and cultural objectives at scale.

Study visits and consultations: Destination managers considering gateway strategies can arrange study visits to operational immersive venues relevant to their context. Origin of Wonder facilitates introductions to existing installations and connects destinations with peers pursuing similar strategies.

Taking action: From overtourism crisis to sustainable model

Overtourism is not inevitable. It results from failure to design visitor experiences that respect carrying capacity while meeting legitimate desires for authentic engagement with iconic places.

Immersive gateways provide tested infrastructure that addresses both sides of this equation: protection and satisfaction, restriction and access, conservation and commerce. The question is not whether such solutions are possible but whether destination managers have the institutional courage and stakeholder support to implement them.

Immediate next steps for overtourism destinations:

Assess baseline conditions: Quantify where and when overtourism pressure concentrates using visitor flow data, resident surveys and ecosystem monitoring

Explore gateway potential: Review the Immersive Destination Analysis dataset to benchmark your context against profiled destinations

Engage stakeholders: Begin conversations with transport operators, conservation authorities and community leaders about gateway concepts

Request feasibility assessment: Work with Origin of Wonder to evaluate site-specific gateway opportunities and develop investment-ready proposals (request assessment)

Study precedents: Visit existing immersive installations to understand visitor response and operational realities

The overtourism crisis will not resolve through incremental adjustments to current management models. Destinations need fundamentally different infrastructure that redirects, prepares and satisfies visitors while generating resources for protection. Immersive gateways provide this infrastructure.

Early adopters will gain competitive advantages as sustainable tourism certification programmes and conscious traveller preferences increasingly favour destinations demonstrating credible overtourism management. Destinations that delay will find themselves defending failing restriction-only strategies while visitor frustration and resident backlash intensify.

For strategic context on the broader immersive investment landscape and evidence base supporting gateway development, see: Origins of Wonder: An Immersive Impact Investment.

About the author: This analysis draws on systematic destination profiling across 88 locations, field assessments in overtourism-affected destinations and structured analysis of immersive infrastructure investments and financing models. The author (Martin Sambauer) works with Origin of Wonder to develop data-driven gateway solutions for destinations under pressure.

Data availability: All datasets referenced are openly available on GitHub with full methodology documentation. Destination managers are encouraged to use these resources in their own planning processes.

Contact Origin of Wonder:

Destination partnership enquiries: originsofwonder.com/destination-partnerships

Feasibility assessment requests: originsofwonder.com/feasibility-assessment

Technical consultations: originsofwonder.com/contact